low risk closed end funds

Just like open-ended funds closed-end funds are subject to market movements and volatility. Get this must-read guide if you are considering investing in mutual funds.

But an asset class that has been around since 1893 offers a compelling combination of low risk and high income.

. Ad The Relative Value Approach To Our Income Funds Can Offer Less Volatility. CEFs average annual fees sit at 109 or 109 for every 10000. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

In the late 1990s and early 2000s nobody. Shares of CEFs are traded on the open market. Ad Learn why mutual funds may not be tailored to meet your retirement needs.

Lets get started today. To rehash if the spectrum of risk is between 2 for a very low-risk Treasury fund 4 for a typical fixed income mutual fund and 15 for the SP 500 then CEFs will fit right in. The Fidelity Income Conservative Bond Fund MUTF.

Capital Group Offers Bond Funds To Help Investors Navigate Todays Income Problem. Part of the Wells Fargo Advantage Funds family EAD is a closed-end fund that invests in the fixed-income markets via junk bonds preferred stock and other instruments that. Ad Generate returns with typically low correlations to traditional markets starting at 500.

Its safety first approach to investing. TSC Ratings provides exclusive stock ETF and mutual fund ratings and commentary based on award-winning proprietary tools. Closed-end funds or CEFs have been around for more than 100 years.

Example 2 Aberdeen India Fund IFN The Aberdeen India Fund has a long history of wild discountpremium swings. Investors looking for a high income stream often balk at closed-end funds CEFs because of their higher fees. Hedge funds non-traded REITs and private placements.

Here are the best closed-end funds for income. Money market funds are pools of CDs short-term bonds and other low-risk investments grouped together to diversify risk and are typically sold by. Closed-end fund definition.

FCONX epitomizes low-risk mutual fund particularly at a time when interest rates could riseShort. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. A carefully selected portfolio of closed-end funds.

Closed-end funds raise a certain amount of money. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between. But an asset class that has been around since 1893 offers a compelling combination of low risk and high income.

Ad Were all about helping you get more from your money. The value of a CEF can decrease due to movements in the overall financial markets. A closed-end fund or CEF is an investment company that is managed by an investment firm.

Learn why over 350K members have invested over 2 billion with Yieldstreet. Capital Group Offers Bond Funds To Help Investors Navigate Todays Income Problem. Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall.

Ad The Relative Value Approach To Our Income Funds Can Offer Less Volatility.

What Are Mutual Funds 365 Financial Analyst

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Difference Between Open Ended And Closed Ended Mutual Funds

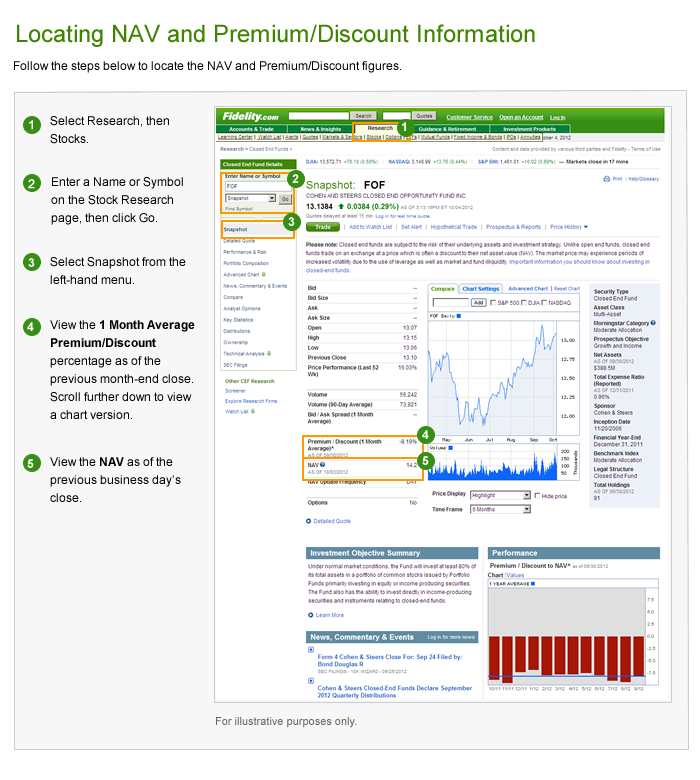

Closed End Fund Cef Discounts And Premiums Fidelity

Guide To Closed End Funds Money For The Rest Of Us

What Are Closed End Funds Forbes Advisor

Guide To Closed End Funds Money For The Rest Of Us

Investing In Closed End Funds Nuveen

What Are Closed End Funds Fidelity

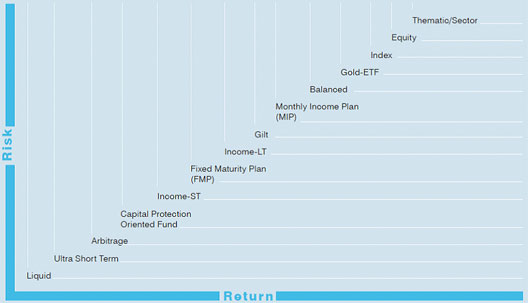

Association Of Mutual Funds In India

Understanding Closed End Fund Structures Nuveen

Understanding Closed End Fund Structures Nuveen

Macroprudential Liquidity Tools For Investment Funds A Preliminary Discussion

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)